How To Use Paytm App In India

Paytm wallet is a secure and RBI-approved digital/mobile wallet that you can use for multiple purposes. It is like digital cash that you can utilize for any kind of consumer payment. You can add money to the Paytm wallet through UPI, internet banking, or credit/debit cards. Also, you can send money from a Paytm wallet to a bank account or another person's Paytm wallet.

You can use the Paytm Wallet to perform the following transactions –

- Pay bills like electricity, challan, broadband/landline, municipal taxes, water, or gas (cylinders or prepaid gas). You can also pay education bills such as school fees or apartment rent

- With Paytm, you can recharge your mobile, landline, or broadband, metro card, DTH, FASTag, Google Play, etc. using Paytm. You can pay mobile postpaid bills as well

- Use your Paytm Wallet to book flight tickets, train tickets on IRCTC, bus tickets, book movies, etc. You can book these either directly on the Paytm application or use Paytm payment modes on applications like BookMyShow, IRCTC, etc.

- With Paytm Wallet, you can pay to avail of services through other partner applications like Uber, Zomato, Flipkart, etc. You can pay directly at these third party/3P apps as well as add money to your wallet

- You can do online shopping through the Paytm Ecommerce site – Paytm Mall as well as other e-commerce sites like Myntra, Ajio, and others. Not only you can use your Paytm wallet for payments on these 3P apps but also check out the offers and vouchers from Paytm to get discounts/cashback

- You can also buy and share gift vouchers with friends or purchase subscriptions to several apps

- Use Paytm to pay credit card bills, loans, or rent

- You can make Paytm FASTag payments as well as bank-issued FASTags' payments from the Paytm Wallet

- Apart from the services and facilities mentioned above, you can order medicines, consult doctors, access various lifestyle or service applications from the mini store

Features of Paytm Wallet

Paytm is by far the largest online payment platform in India that allows users to transfer money to anyone using the Paytm wallet at zero cost. It also helps in the payment of utility bills, book movies/tickets, or avail various services from partner applications. Here is what you must know –

- Paytm Wallet is safe, secure, and approved by the Reserve Bank of India

- The money in your Paytm wallet is like ready-to-use cash that you can access at any time and any place

- You can add money to your Paytm wallet using a credit card, debit card, net banking, or UPI

- Add up to INR 10,000 in a month after completion of minimum KYC which is an easy process. You can do minimum KYC with Voter ID, Passport, Driving license, or even NREGA Card to activate the Paytm Wallet

- After completing full KYC verification which you can do either via Video KYC at the comfort of being at home or by visiting the nearest KYC center, you can upgrade the monthly limit to INR 1 lakh

Benefits of Paytm

There are many advantages of using a Paytm Wallet. It not only makes online payments easier and faster but also safer. It gives an overall better experience to the user. What you need to know is that –

- Paytm Wallet helps in cashless and digital payments. It is safer as you do not pay through the bank directly

- Payments are quick and convenient for the users

- You get various cashback, offers, scratch cards, rewards, and discounts on making payments

- Get easy refunds from partner applications in case of cancellation or return of orders or any other issue at the partner stores if the payment has been made using Paytm

- You can avail of the Paytm Postpaid facility if you have a good credit history with Paytm

- Linking your Paytm account with your FASTag account makes it further easier for you to travel through toll plazas across the country. You can recharge the FASTag that you buy either from Paytm or any provider. If your FASTag is linked to your Paytm wallet, the amount directly gets deducted. You don't have to go through the hustle of recharging your FASTag every now and then

- Paytm Wallet is accepted at all QR Code payment gateways

- Paytm allows you to have sub-wallets like food wallets, or that of fuel and gifts. You get exclusive offers, it is widely accepted and can have a seamless payment experience. It can also help to save tax and has several benefits for the employers and the employees

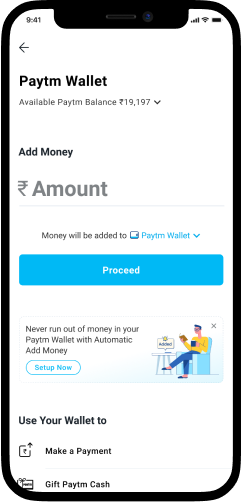

- You can also set up the 'Automatic Add Money' feature, wherein you can fix the amount for automatic addition. Paytm will add that amount to your wallet from your bank account. It adds whenever the wallet balance goes below a certain amount that you decide

- You can set payment reminders on Paytm wallet which keeps you from missing out on any bill payments

- Through the 'Spend Analytics' feature, you can keep a track of your expenses as to where the money has been spent. This will also help you in planning your monthly budget and future expenses

- Similar to a bank statement, you can also request a wallet statement for the previous 1 month up to the previous 1 year or any other customized time period

- You can not only add money from bank to wallet but also send money back to the bank or transfer it into another bank account (minimal charges applied)

- Paytm wallet offers you 24×7 Help access for resolving any issue that you might face. You can call or message on 0120-4456-456 for any query related to bank, wallet & payments. Alternatively, you can also go to your account by clicking on the profile picture on the top left side of the mobile application. Scroll down to '24×7 Help' and click on it

- The password feature of the Paytm application makes it safer, as the money in your wallet remains safe even if the mobile is misplaced or lost

How to Use Paytm Wallet?

Paytm Wallet is quite simple and convenient to use. All you need to do is register once, free of cost and log in anytime to use it. You can also stay logged in to the application on your mobile by securing it with a password, pin, or touch security/fingerprints.

Follow the below steps to create an account and make benefits of the Paytm wallet, without paying any charges –

Step 1: Download the Paytm app on your mobile phone. Create an account by signing up using your email id

Step 2: You can always go to your profile on the app and alternatively, you can also visit Paytm's official website. Once you go to this link on your operating system, scan it with your Paytm app on the phone. Now you can access your profile on desktop as well

Step 3: Once your account is registered and verified through One Time Password (OTP), you can add money to your wallet. You can add through credit/debit cards, UPI, or net banking

Step 4: If you wish, you can save your card details or bank UPI details for easier and faster transactions. It is safe and secure

Paytm is the first and the largest virtual wallet with millions of users who do financial transactions daily. Online payments are done with 128-bit encryption SSL security to ensure security. CVV of the credit/debit cards is never stored on the app for consumer safety purposes.

In case you lose access to your account or lose your mobile, you can always call on customer care number 0120-4456-456 to block your account. Alternatively, you can also reach out at care@paytm.com. Likewise, Paytm may block the account if it detects fraudulent activities and you may reach out to customer service for the resolution of the issue

Yashi Das is a Financial Content Writer who attempts at articulating complex topics in a simpler fashion for readers. When not writing, she is a social media enthusiast.

How To Use Paytm App In India

Source: https://paytm.com/blog/paytm-help/what-is-paytm-wallet-and-how-to-use-it/

Posted by: albanesethenteavill.blogspot.com

0 Response to "How To Use Paytm App In India"

Post a Comment